SBI Long Term Equity Fund: A consistent fund for your tax saving needs

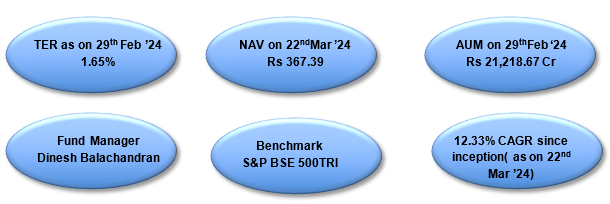

The SBI Long Term Equity Fund is an open-ended Equity Linked Saving Scheme (ELSS) with a tax saving benefit and a statutory 3-year lock-in period, which was started in March 1993. The scheme aims to deliver Equity returns to its investors along with the tax deduction benefits as provisioned under 80C of Income Tax Act 1961. It also seeks to distribute income periodically depending on distributable surplus for investors who choose the IDCW plan (Source: Advisorkhoj and Fund Factsheet as on 29th Feb 2024).

Why invest in an ELSS fund?

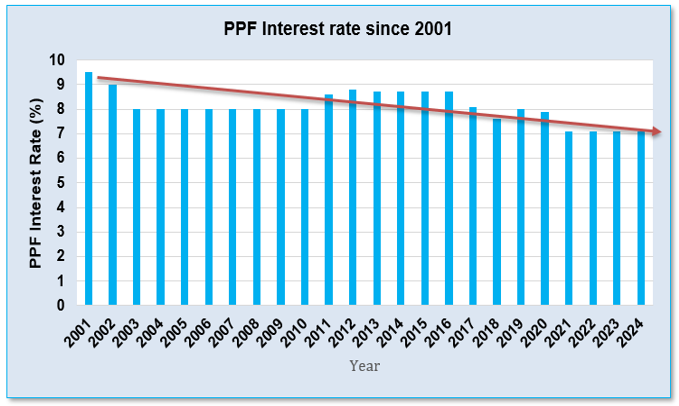

- Interest rates of 80C Government Small Savings Schemes like PPF rates have been steadily declining over the long term.

Source: Advisorkhoj

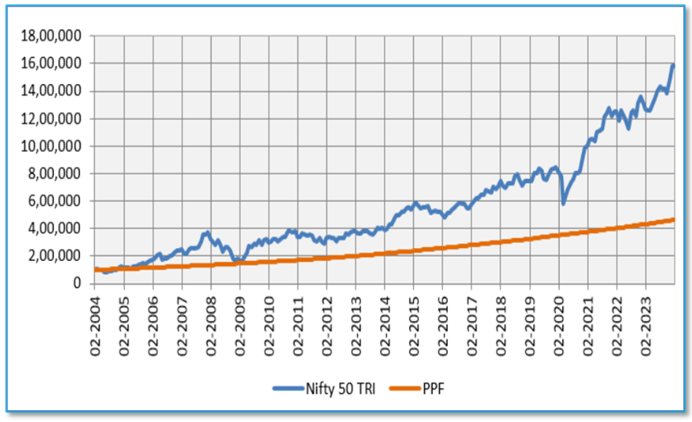

- Historically, equity investment has given better returns compared to other asset classes in the long term. See the chart below which shows the returns from a Rs 1 lakh investment in Nifty 50 TRI compared to returns from PPF over the last 20 years.

Source: NSE, Advisorkhoj as on 29th February 2024

- Since there is a 3-Year mandatory lock in period, investment in ELSS gets a chance to grow in value for the lock in period, delivering long term equity growth for the investors.

- ELSS returns are tax efficient. Returns from the fund are not taxed unless the units are redeemed. Therefore, you can defer your taxes on gains from the ELSS. Moreover, returns from ELSS are taxed as Equity Long-Term Capital Gains, where Rs1 lakh is exempt in a financial year and the rest is taxed at 10%.

Beyond Tax Savings – exempt, creation

Tax savings may not be the sole purpose of investing in ELSS. ELSS funds are essentially diversified equity funds with a lock-in period of 3 years. The lock-in period ensures less redemption pressures on the fund manager and facilitates investments in high conviction stocks which have the potential of wealth creation over long investment horizon. SBI Long Term Equity Fund has a great long term record of wealth creation.

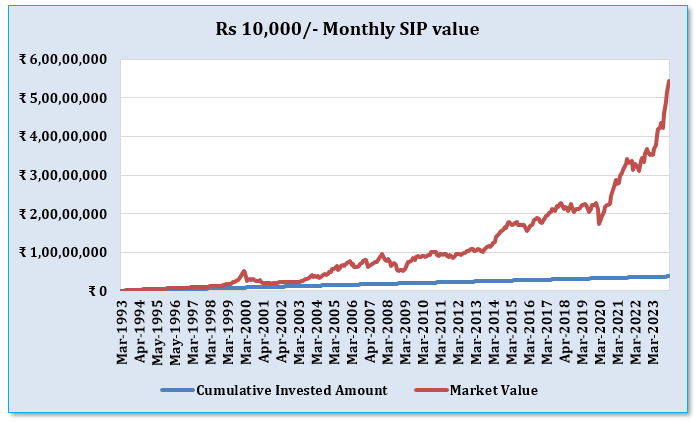

A Rs 10,000 monthly SIP in the SBI Long Term Equity Fund since its inception would have grown to Rs 4,97,99,157 (Rs 4.98 crores) as on 22nd March 2024 against a cumulative investment of Rs 37,20,000 (Rs 37.20 lakhs) giving an XIRR of 13.76%. (See chart below)

Source: Advisorkhoj

As more people choose the new tax regime, they can still use this fund as a good diversified equity fund for long term investing. Also new / young investors who are below 7 lakhs salary can use it for long term wealth creation along with tax saving.

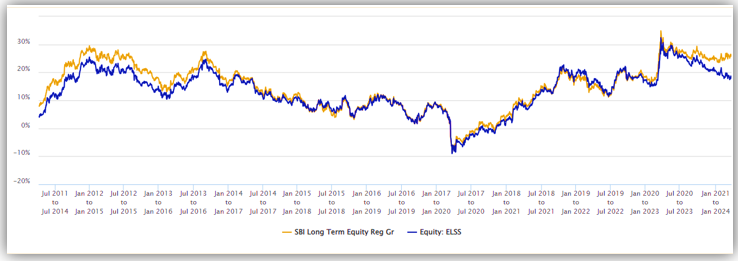

3-year Rolling Returns

The 3- year rolling returns of the SBI Long Term Equity Fund in the last 14 years (Since April 2010 to 26th March 2024) is given below. The fund gave an average return of 14.92% in this period against the category average return of 13.32%. In this period, the fund gave 15%+ CAGR returns 51% of times, 20%+ CAGR returns 29% of times; both of which are higher than the category average returns distribution.

Source: Advisorkhoj Research

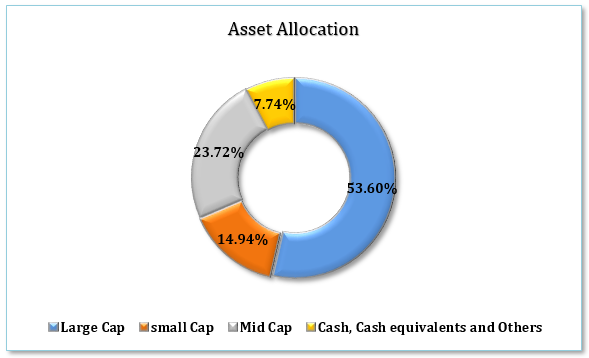

Investment Strategy

SBI Long Term Equity Fund will be investing in equity & equity related instruments, derivatives as also debt instruments, and money market instruments (such as call money market, term/notice money market, repos, reverse repos and any alternative to the call money market as may be directed by the RBI). The fund currently has a large cap bias.

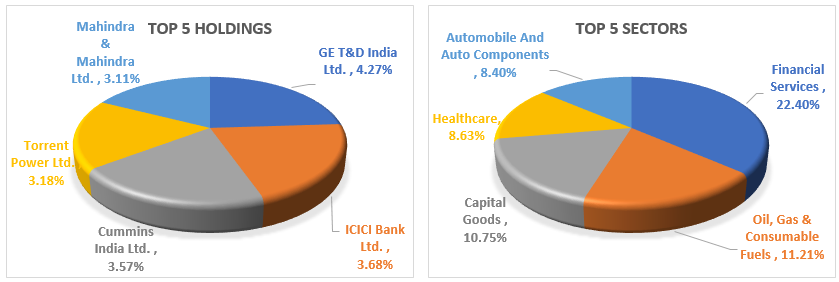

Fund Portfolio

Source: SBI Long Term Equity Fund factsheet as on 29th Feb 2024

Who should invest in SBI Long Term equity Fund?

- Investors who have chosen the Old Regime of taxation and are looking for tax savings under section 80C of Income Tax Act 1961.

- Investors who have opted for New Tax Regime but are looking for capital appreciation over minimum 3+ years tenure can also invest in this fund.

- Investors with moderately high to high-risk appetites. Consult with your financial advisor, if you are unsure about your risk appetite.

- Investors with minimum 3- 5 years investment horizon

Consult with your financial advisors or mutual fund distributors if SBI Long Term Equity Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

- SBI Contra Fund: Great wealth creation track record

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY